Here at Insight Data, the glazing industry research and data company, we recently carried out an industry survey, telephoning 2,500 installers to gauge the ‘temperature’ of the industry.

Our survey asked 12 questions to understand how installers were faring compared to pre-pandemic levels and the results highlight some major alarm bells – as well as new opportunities ahead.

The survey was unveiled at the Glazing Summit by our CEO Andrew Scott, who shared the data with 420 delegates.

“This survey goes straight to the heart of the industry, asking front-line installers about the key metrics in their business – enquiry levels, conversion rates, pricing levels, margins and consumer sentiment,” said Andrew.

“It is essential that the whole supply-chain take notice, from fabricator through to component suppliers as it presents some potential risks – and opportunities.”

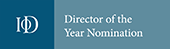

Enquiry Levels

We wanted to know how enquiry levels compared with pre-pandemic levels. 63% of installers reported a consistent increase, with 37% saying they had a much higher level of sales leads.

This is good news for the industry and is set to continue as demand for home offices, gyms and more living space remains strong following the shift in working patterns and increase in working from home.

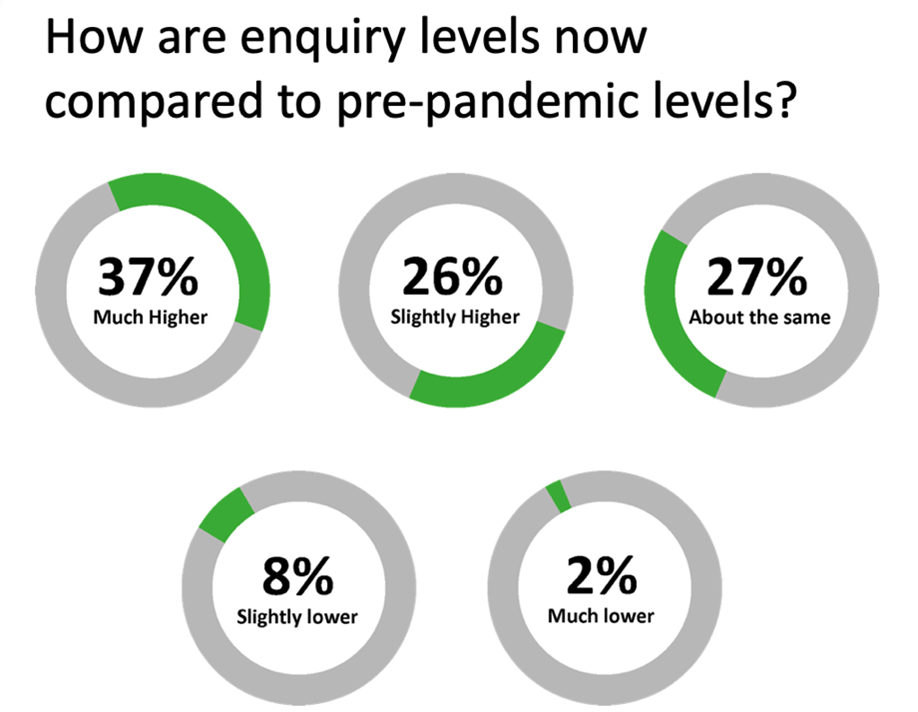

Conversion Rates

Of course, more sales leads are meaningless unless they convert into orders. Our Installer Survey showed that installers had seen an increase in conversion, too. Indeed, 53% of installers reported slightly higher or much higher improvement in conversion, demonstrating that homeowners were investing in their homes.

While there are signs of the market stabilising, a new demand for home offices, home gyms and more space is likely to be maintained following the shift in working patterns and working from home.

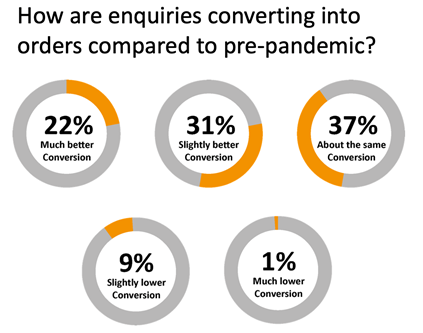

Price Sensitivity

We wanted to know how price-sensitive consumers are now compared to pre-pandemic and while installers reported 27% of homeowners were more price-conscious, 39% were less price-conscious – meaning 39% were happy to pay more. The two primary reasons were product quality (18%) and lead times (21%).

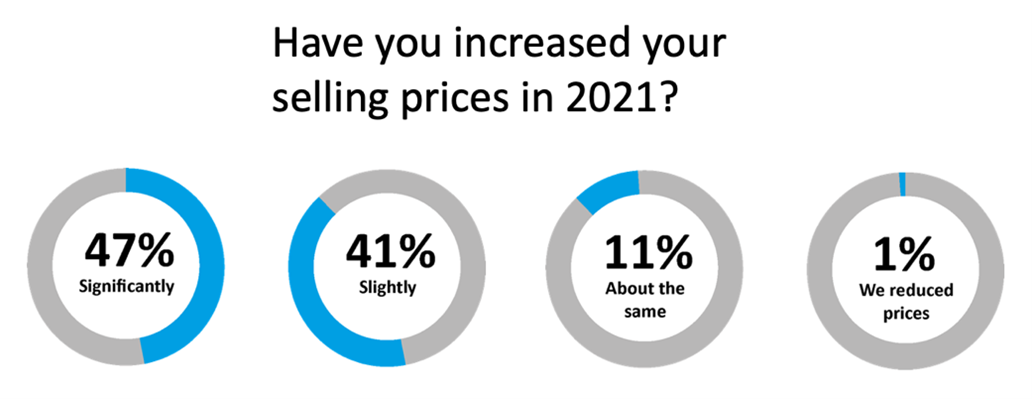

Selling Prices

Next, we asked installers whether they had increased their selling prices this year. An overwhelming number (88%) reported they had increased prices slightly or significantly.

Given that sales conversion rates were not affected – indeed 53% of installers said conversion rates were better, it appears consumers are happy to pay more.

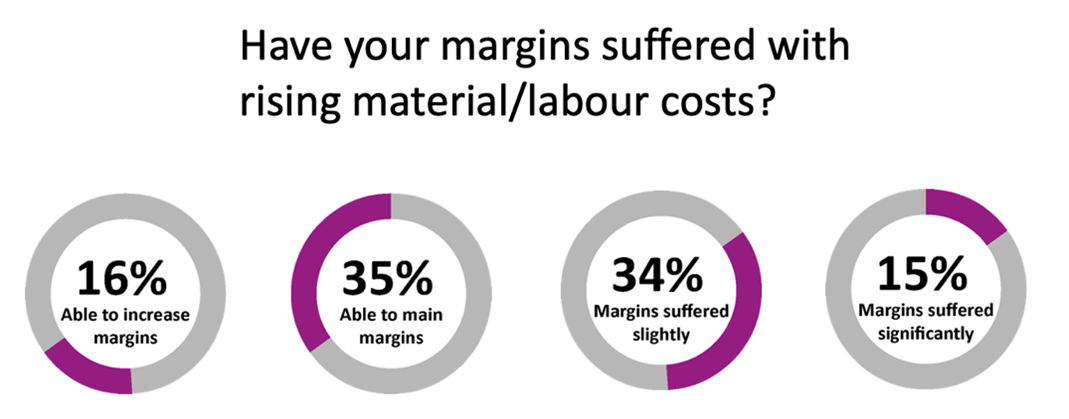

Margins

On the question of margins, the results are less promising. 49% of installers say their margins have been eroded despite the fact that 88% have increased their selling prices.

Opportunities in the long term

“There are lots of positives,” says Andrew. “Enquiry levels, conversion rates and even selling prices are up. But despite this installer margins are being eroded.

“One of the major problems is that installers have secured more orders without the resources to fit them (due to supply-chain and labour issues). While on paper this looks healthy with bulging forward order books, the long lead-times will have a detrimental impact on margins.

“Jobs sold 4 or 5 months ago (or longer) were based on material costs at that time, but when these jobs are actually fitted, costs may have risen sharply – both materials and labour. There is a risk many jobs will be fitted at breakeven or worse and it is near impossible to ask homeowners to pay more just as the job is due to be fitted.

“However this is a short-term situation and as supplier prices eventually stabilise and installers can base selling prices on more reliable costs, there is a real opportunity for installation firms to capitalise on higher-order values, better margins and higher consumer demand.”

The Insight installer Survey was carried out over 4 weeks between September and October 2021 via telephone interviews with the Insight Data research team.

The survey consisted of 12 questions and full details can be found as part of the wider Insight Report 2021. To register to receive a copy, visit insightdata.co.uk/reports.