Insight Data are the renowned glazing industry research and data company, has reported another decline in companies active in the market.

The latest 2021 report shows some stark facts and figures that were presented at the recent Glazing Summit Conference by Insight Data’s CEO, Andrew Scott.

But it’s not all bad news says Alex Tremlett, Insight’s Operations Manager who points to consolidation creating further opportunities in the industry.

Alex commented;

“Andrew announced at the Glazing Summit some interesting trends which points to some realignment in the industry. The number of firms has declined, but this creates less competition and could be good for the industry.”

The number of fabricators and installers has dropped below 14,000 firms for the first time on record. Indeed, over the last two years (October 2019 to October 2021) a staggering 709 firms have been removed from our Fenestration and Glazing database.

Some of these have gone bust, but many have simply retired and closed their doors, the impact of the pandemic being the final straw. Others have been the subject of a takeover or merger, particularly as companies utilise low-level acquisitions as a way of acquiring staff and resources.

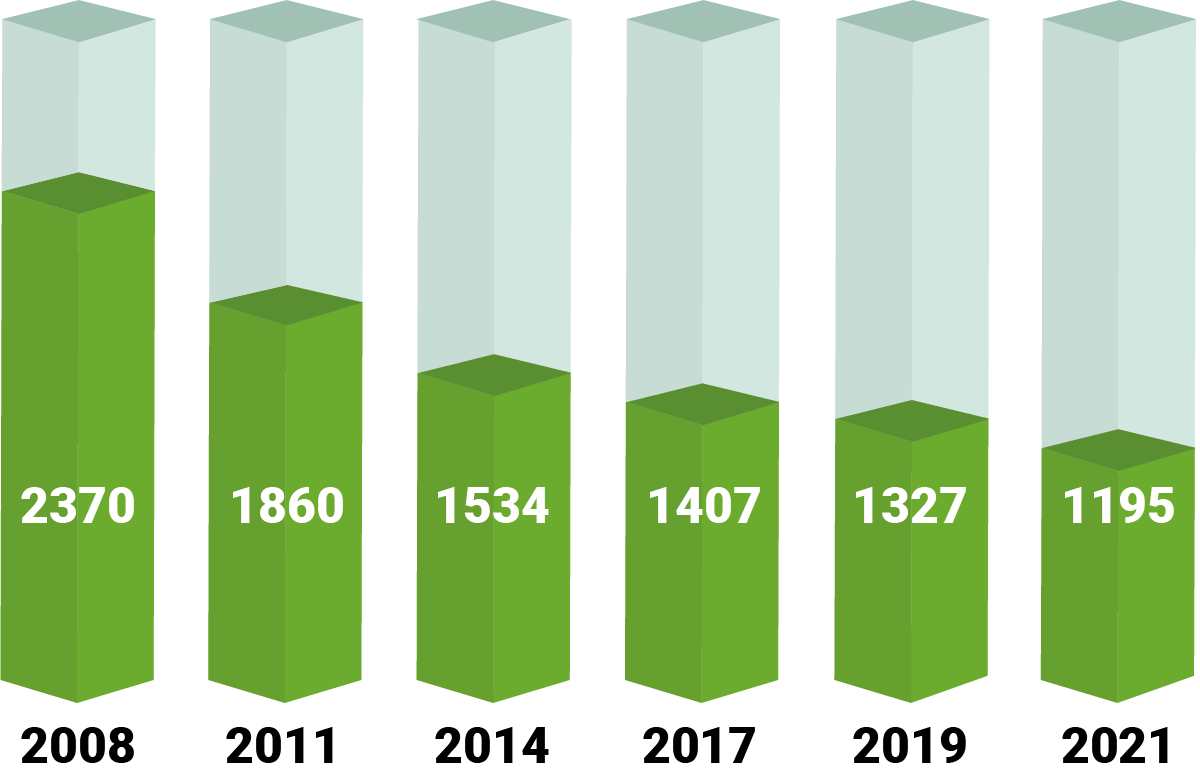

PVC-U Fabricator Decline

The most striking figures show a significant drop in the number of PVC-U fabricators. Over the last ten years (2011 to 2021) this has reduced year-on-year from 1,860 firms to just 1,195 – a drop of 35%.

The three primary reasons for this are;

- Companies ceasing to fabricate to focus on installation/supply only

- Mergers and acquisitions as companies acquire competitors

- Business failure, most recently Sash UK, Total Glass and Indigo Products

While some capacity has been absorbed by the existing manufacturers who have increased production output, the drop in fabricators has resulted in less supplier choice for those buying in frames, and reduced competition among fabricators.

It should be noted that while PVC-u fabricators have declined, the number of aluminium fabricators has increased by 18% from 750 to 884 over the same 10 year period – with many PVC-U fabricators now adding aluminium to their portfolio of products.

Number of PVC-U Fabricators

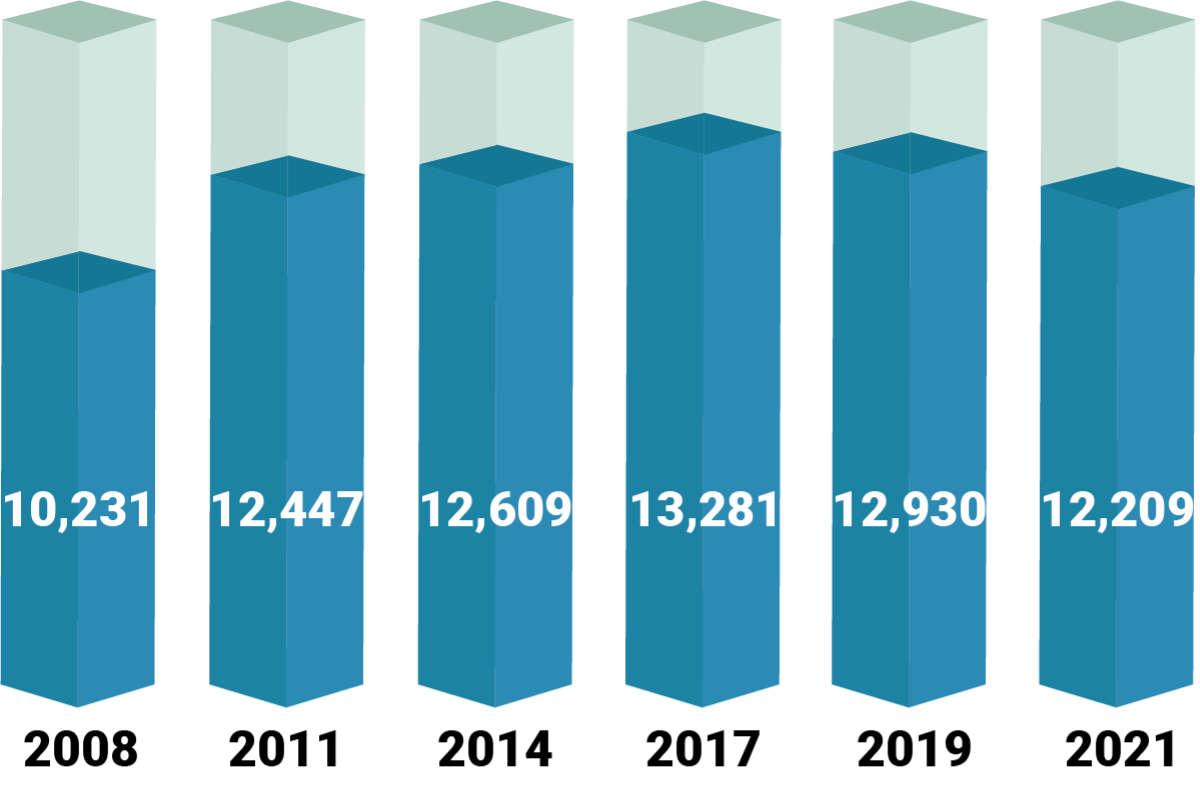

Installers at the sharp end

The number of installers across the UK has steadily increased year-on-year until 2017, when the trend reversed. This was driven mainly by owner retirement, but also through a string of mergers/acquisitions and the collapse of several firms.

There are now 12,209 specialist double glazing installers on the Insight database. Most have now diversified, offering a wider range of windows and doors, conservatories and other home improvement products.

Despite the move to online sales experienced by many industries, installers with showrooms appear to be faring better than ever, and indeed many are investing in new and improved showrooms to demonstrate a wider portfolio of products.

Insight Data tracks in-depth installer information, including which systems they use, product volumes, financial data, showrooms and other information.

It is interesting to note that despite extremely difficult supply-chain issues, most installers remained with their existing suppliers. Loyalty may be a factor, but lack of supplier choice may be another as fabricators reach capacity and turn-away new customers.

While order books and sales remain strong, labour shortages and supply-chain issues have resulted in most installers having much larger pipelines and extended lead-times, at a time when material pricing is very unstable.

Number of window and door installers

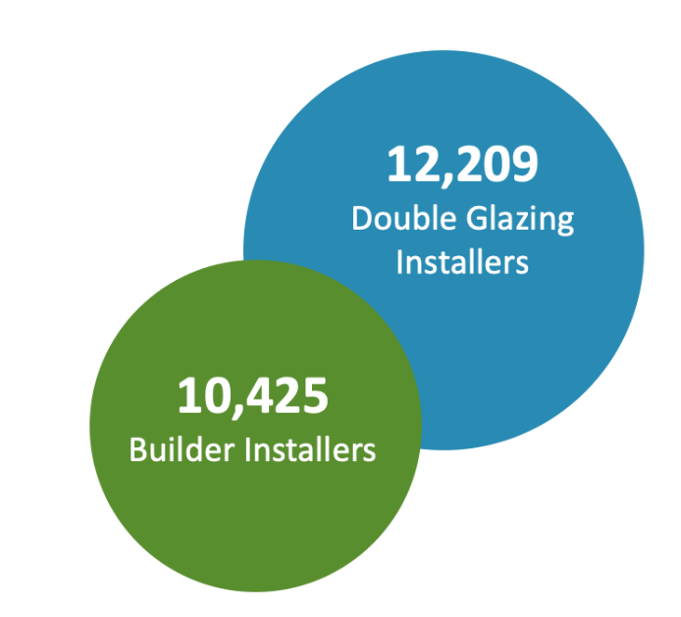

Builder-Installers

While the number of double glazing firms has declined, there is a rising movement among general builders now focusing directly on windows and doors and providing homeowners with extensions and other home improvements.

In fact, within our Local Builders Database over 10,400 builders say they actively advertise or promote windows and doors and so in reality, we have over 22,000 firms selling windows, doors and conservatories, many of which source their supplies through builders merchants and trade-counters, not necessarily directly from fabricators.

Conclusion

From a fabricator and installer perspective the industry is consolidating, with fabrication capacity reducing at a time when demand among homeowners has increased. Coupled with supply-chain issues and labour shortages the sector has faced the ‘perfect storm.’

However with signs of the supply-chain improving and consumer demand predicted to continue in 2022, less competition in the market place may prove beneficial for all concerned.

This is an extract from the full Insight Data Report 2021, which will be available shortly. Interested parties can register to receive a copy.