Insight Data has surveyed the top 500 companies within the fenestration industry on their thoughts on Brexit. Split into two reviews, Insight Data will reveal the responses given by the industry and provide some expert analysis.

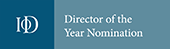

77% of those who responded agreed or strongly agreed that their business plans would stay the same despite Brexit. The response suggests that planning for an outcome of some sorts, has been taking place across the companies surveyed.

Jade Greenhow, Operations Director at Insight Data comments:

“It is positive to see the industry has in the majority been preparing for Brexit. To those who may change their business plans or who are unsure, having a strong business plan, including key strategic lead generation and product development improvements are going to be pivotal with whatever happens with the Brexit deal.”

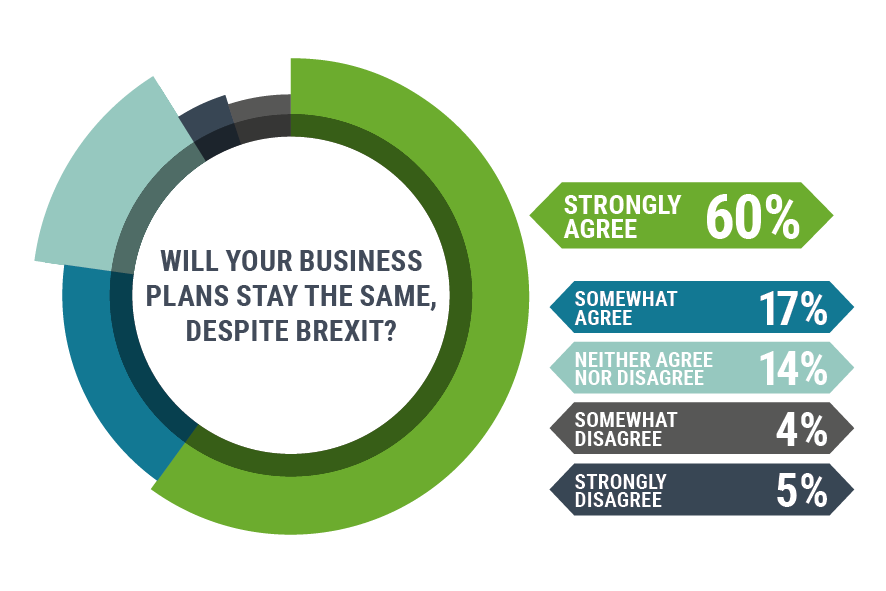

With many business plans staying the same, its noticeable that fenestration companies have been preparing for a rise in the cost of imports. 67% of companies surveyed expected a rise in costs after Brexit.

Jade Greenhow comments:

“It is yet to be seen what the increase in import costs will have on the industry. The fall in the pound means companies who are operating on very low margins are likely to flounder, however that does give opportunities for others to pick up the slack. Despite many opportunities currently available, Brexit may finally push manufacturers of highly advanced product lines to export further afield into the Asian and African markets for example.”

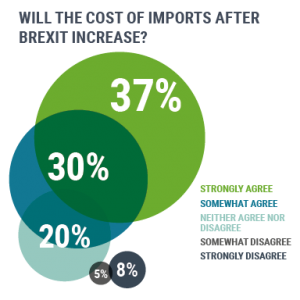

Overall, 69% of fenestration companies see the outlook for the industry being positive.

Jade Greenhow comments:

“The industry is clearly seeing Brexit as not being as bad as expected. Consumer spending has declined but remains high enough to keep profits growing. Once Brexit is finalised with a deal of some sorts, no-deal or even no Brexit, the fenestration industry appears to be in a positive incline.”

While the surveys conducted provided mainly one-sided responses, it is important to note that some respondents do disagree. The 9% of businesses who will be changing their business plans in accordance with Brexit are flexible on making any necessary changes required.

Having a business model which can adapt to different scenarios is certainly a positive feature. Import costs will ultimately depend on the value of the pound. If parliament can come together and agree on the outcome of Brexit, there is a possibility that the pound will increase, halting the increased cost of imports.

Insight Data have the platform to ensure continued lead generation won’t fluctuate despite any political or economic uncertainty. Salestracker, a powerful CRM system and integrated email marketing platform is critical to sending out the right marketing messages, to the right audience.

Trusted by over 700 users across major system houses to small lifestyle fabricators, Salestracker is an integral part to generating regular, high quality leads. The research was conducted by Insight Data’s in-house research department which regularly supports businesses with their own research campaigns.

Read part 2 here.

For more information contact Insight Data on 01934 808293 or via email at hello@insightdata.co.uk